5 Reasons to Invest in East Bangalore Over North Bangalore

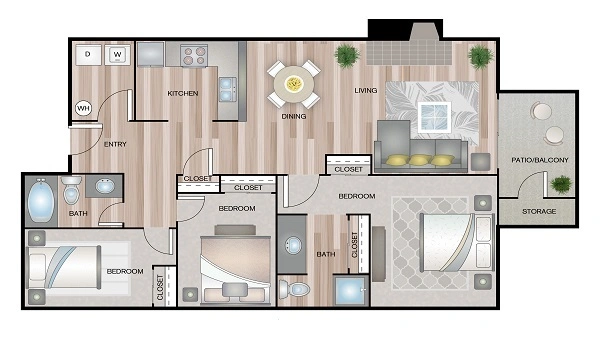

East Bangalore is the smarter choice for homebuyers in 2025. The average property rate here is ₹9,027 per sq. ft., and rental returns are around 4% to 4.5%. A 2 BHK flats in a gated community in Whitefield can fetch up to ₹45,000 per month. In contrast, North Bangalore usually sees rents between ₹15,000 to ₹40,000, depending on the area.

In East Bangalore areas like Whitefield and Sarjapur everything is ready. You get metro service, the Outer Ring Road, malls, hospitals, and schools all within 15–20 km of the city center. North Bangalore Hebbal, Yelahanka, Devanahalli are still under construction. Major projects like Metro Phase III, airport upgrades, and ring roads won’t be fully done until 2026 or after.

East also shows strong returns. Some projects have earned 25% extra value from launch to move-in. North saw plot prices near Devanahalli double, but those gains now depend on future projects being finished.

Some of the 5 major reasons to investment on East Bangalore are:

- East Bangalore Is a Better Choice for Rental Income: East earns steady rental returns of 4–4.5%, with gated 2 BHKs getting ₹45,000/month. In North, 2 BHKs usually rent for ₹15,000–₹40,000/month in places like Hebbal and Yelahanka. The overall average rent in the city was 4.45% in early 2024, thanks to East Bangalore.

- East Bangalore Has Full Infrastructure Ready: East already has the Purple Line metro, Outer Ring Road, and more than 10 IT parks employing lots of professionals. North is still waiting on big projects like Metro Phase III, ring roads, and suburban rail, which may only arrive after 2026.

- East Bangalore Offers Stable Prices: East sees stable prices around ₹9,027/sq ft, with some new buildings gaining 25% value from launch to handover. In the North, Devanahalli land shot up from ₹3,500 to ₹7,000–8,000/sq ft, but areas like Hebbal dropped by 27%, showing a bumpy ride.

- East Bangalore Wins on Lifestyle: East gives you malls, international schools, and hospitals within 15–20 km of the city center. It’s ideal for families. North is still building these features and cannot match East’s level of lifestyle today.

- East Bangalore Is Lower Risk, North Is High Reward: East brings steady rent and steady price growth thanks to its mature setup. North may deliver big gains later, but it is still infrastructure-dependent, making it a riskier bet right now.

Yes, East has stable rent returns, ready setup, and solid price growth. North may yield high gains but needs key projects to finish first.

Yes, current figures show 4.45% average rent return in early 2024, led by East Bangalore.

Yes, land may have doubled in some places, but areas like Hebbal saw price drops until new projects arrived.

Nambiar Group pre launch project is Nambiar District 25

| Enquiry |